No matter whether you’re a fiscal advisor, investment issuer, or other financial Experienced, discover how SDIRAs may become a strong asset to improve your enterprise and obtain your Qualified plans.

When you’ve found an SDIRA service provider and opened your account, you might be questioning how to really commence investing. Comprehending both of those The principles that govern SDIRAs, as well as tips on how to fund your account, might help to put the muse for any way forward for productive investing.

Unlike shares and bonds, alternative assets tend to be harder to market or can come with rigorous contracts and schedules.

Before opening an SDIRA, it’s important to weigh the possible pros and cons depending on your unique economical plans and possibility tolerance.

As an investor, on the other hand, your choices will not be restricted to stocks and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Including income directly to your account. Take into account that contributions are issue to annual IRA contribution restrictions established with the IRS.

Transferring resources from a single variety of account to another sort of account, which include shifting money from the 401(k) to a conventional IRA.

IRAs held at banks and brokerage firms supply minimal investment options to their customers given that they would not have the expertise or infrastructure to administer alternative assets.

No, You can not put money into your own private business enterprise by using a self-directed IRA. The IRS prohibits any transactions among your IRA and your have organization because you, as being the operator, are viewed as a disqualified particular person.

An SDIRA custodian differs simply because they have the suitable team, knowledge, and ability to keep up custody of your alternative investments. The initial step in opening a self-directed IRA is to locate a provider that is certainly specialised in administering accounts for alternative investments.

Certainly, real estate is one of our customers’ most popular investments, often identified as a housing IRA. Shoppers have the choice to take a position in almost everything from rental Homes, industrial property, undeveloped land, mortgage loan notes and much more.

Greater investment options means you can diversify your portfolio further than stocks, bonds, and mutual funds and hedge your portfolio versus current market fluctuations and volatility.

Several buyers are surprised to discover that using retirement money to take a position in alternative assets has been attainable since 1974. Nonetheless, most brokerage firms and financial institutions focus on providing publicly traded securities, like stocks and bonds, as they deficiency the infrastructure and know-how to manage privately held assets, like like it real-estate or personal equity.

Therefore, they tend not to market self-directed IRAs, which offer the pliability to invest in a very broader selection of assets.

A self-directed IRA is definitely an unbelievably effective investment car or truck, however it’s not for everyone. As being the saying goes: with fantastic ability comes good responsibility; and with the SDIRA, that couldn’t be additional legitimate. Continue reading to learn why an SDIRA may well, or might not, be to suit your needs.

Client Help: Seek out a supplier that offers focused aid, together with use of well-informed specialists who can answer questions on compliance and IRS policies.

Due Diligence: It truly is termed "self-directed" for any motive. With an SDIRA, you might be fully responsible for extensively exploring and vetting investments.

Entrust can guide you in paying for alternative investments together with your retirement funds, and administer the shopping for and advertising of assets that are usually unavailable by way of banking institutions and brokerage firms.

Criminals often prey on SDIRA holders; encouraging them to open accounts for the goal of generating fraudulent investments. They frequently idiot buyers by telling them that In the event the investment is recognized by a self-directed IRA custodian, it have to be authentic, which isn’t correct. All over again, Be sure to do extensive homework on all investments you choose.

Rick Moranis Then & Now!

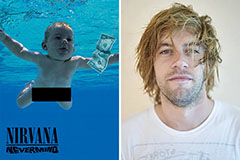

Rick Moranis Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now!